Payroll that understands shifts, classes, and real life.

Jebra automates pay for hourly employees and contractors—across subbed classes, attendance incentives, overtime, and more. Run unlimited payrolls, file taxes on time, and give your team a clean paycheck every time.

Trusted by 180+ businesses and 8,000+ workers

Payroll designed for shift work.

We calculate pay from real schedules and time, not just flat hours—perfect for studios and shift-based businesses.

Insights tailored for shift-work.

Choose “Calculation & Reporting” to centralize timesheets and generate branded payslips—or upgrade to “Processing with Tax Filing” for direct deposit, multi-state payroll, remittances, year-end forms, and unlimited off-cycle runs.

Integrated Solutions for Employees and Contractors.

Connect Mariana Tek today (Mindbody Q4 ’25), then sync sales and fees straight into QuickBooks—saving finance hours every month.

For teams and workers.

Managers get dashboards and error checks; workers get a portal for self-onboarding, invoices, work history, and transparent payslips.

Run payroll in minutes

Run payroll as many times as you need—no extra fees. Jebra calculates complex pay rules automatically: hourly rates, class-based bonuses, subbed sessions, and % revenue splits. Approve in just a few clicks, or set it to AutoPilot™ so payroll runs itself.

With Jebra, you can even schedule off-cycle runs and hold onto your cash until payday—your team still gets paid accurately and on time.

Integrated platform

Everything you need, built around payroll.

Jebra connects the moving parts of your business—scheduling, attendance, sales, and accounting—so payroll runs without messy imports or double-entry. Every feature works together on one platform: payroll automation, advanced reporting, branded payslips, error detection, and self-service for your team.

Mariana Tek

Sync classes, attendance, and revenue-based pay

QuickBooks

Push sales, refunds, fees, and items daily

Xero

Accounting integration (coming soon)

Mindbody

Scheduling + Attendance

Stripe

Payments, fees, and refunds sync

AI Agents

Write a brief description of the product's capabilities

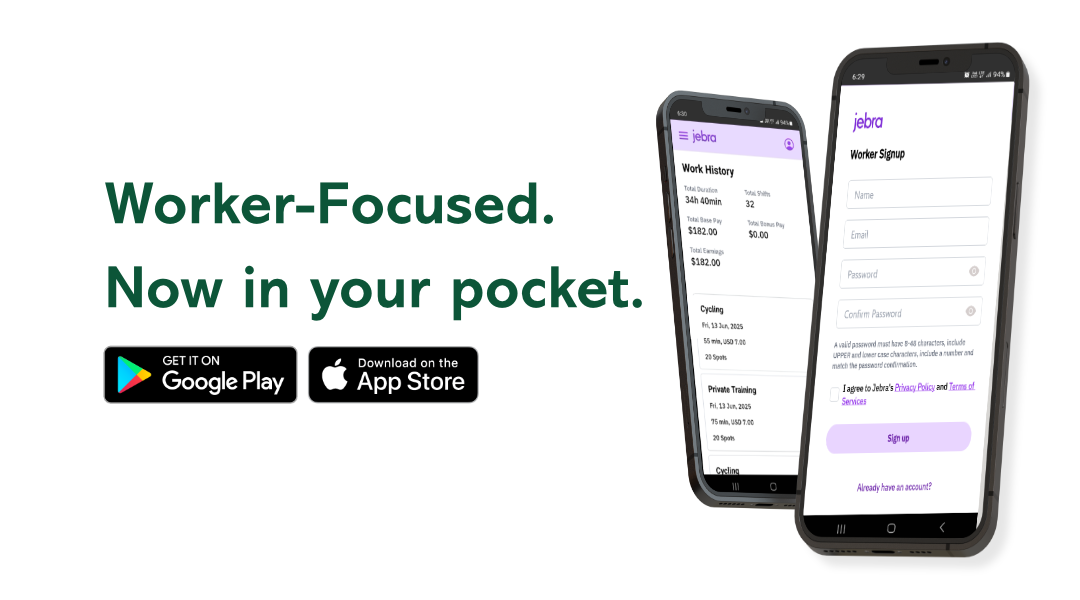

Self-service.

Workers can onboard, submit invoices (when applicable), view history, and keep info current—reducing back-and-forth for your team.

Transparent payslips.

Branded, itemized, and delivered in bulk—so everyone sees how their pay was calculated.

FAQs

Do you support multi-state payroll and tax filings?

Yes—on the Processing with Tax Filing plan, including remittances and year-end reporting.

How many payrolls can I run per month?

Unlimited, including off-cycle runs.

Can I pay both employees and contractors?

Yes. Jebra supports hourly W-2 employees and 1099 contractors, plus incentives and ad-hoc items on a single run.

What integrations are available?

Mariana Tek (live), QuickBooks sync for sales/fees/items, and a growing marketplace. Mindbody planned for Q4 2025.

How do workers access their pay info?

They get a self-service portal with branded payslips, invoices (if applicable), and work history.

Can I start with calculations only?

Yes—begin with Calculation & Reporting for $50/mo and upgrade to full processing with filings anytime.

Want to learn more? Book A Demo

See how Jebra saves you hours of work with payroll, reporting, and accounting

-1.png?width=125&height=125&name=jebra_circle1%20(1)-1.png)